Below is a list of factors to consider when understanding your coffee/tea manufacturing and/or brand.

Public Information to Follow

Financial Model Considerations

- Irregular cash flow

- Seasonality of orders: Hot coffee tends to be a colder weather drink. Seasonal brews should be factored in appropriately.

- Wholesalers payment terms and conditions

- Profit drivers

- Brand – A deep understanding of your total addressable market and how your brand resonates and captures this market. This area will be baked into your assumptions and revenue drivers.

- Managing inventory – Make sure demand matches your finished goods production throughout the year. Important metrics will be:

- Days Sales of Inventory (DSI): (Avg inventory/COGS) * 365 which measures the average number of days it takes to sell off inventory.

- Inventory Turnover: (COGS/Avg Value of Inventory) which measures how many times inventory has been replaced in a period.

- High utilization of assets (if you are roasting the beans yourself) – maximizing production and minimizing waste. This will require monitoring unfinished to finished goods.

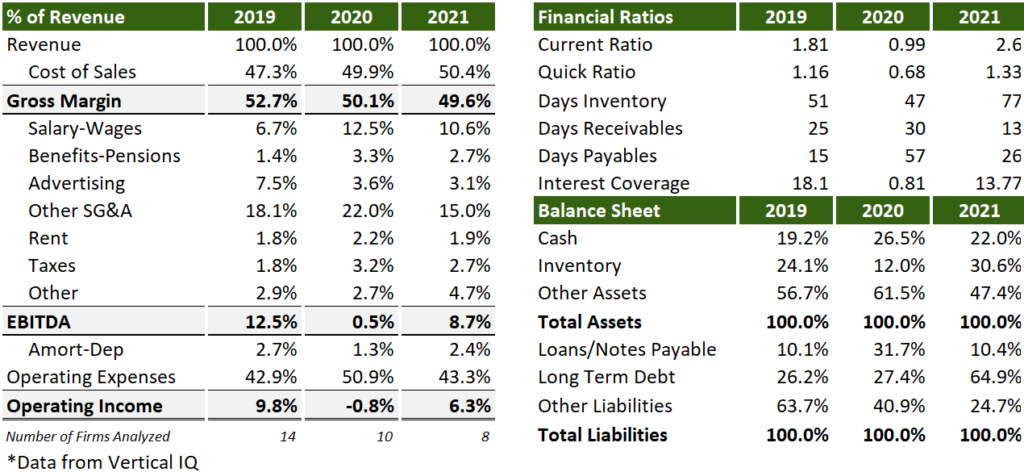

Recent Industry Metrics (Companies <$5M revenue)

Highlights from this vertical analysis and financial ratios:

- Advertising in the post pandemic world is half 2019 (revenue is higher year-over-year)

- Higher cost of coffee beans towards the end of 2021 weren’t passed along to the consumer

- Manufacturers are delaying payments (days payables increasing) to venders and shortening the time to receive payments (days receivables cut in half) compared to pre-pandemic

- Cash and other short term assets are higher than pre-pandemic (current ratio)

For more information on building financial models see here.

Please contact me here if you found this useful or want more information.