What’s in this edition:

- News/Publications to follow

- Financial considerations for your Coin Laundromat business plan

- Industry metrics for guidelines

Public Information to Follow

- American Dry Cleaner

- Coin Laundry Association

- American Coin Op

- National Federation of Independent Businesses

- Huebsch

Financial Considerations for your Business Plan

Cash collection

Since many laundromats are coin based (but transitioning out of), make sure your bank is friendly with cash deposits.

Funding Investments in Equipment and Amenities

Laundromats need to invest in new washers and dryers to stay competitive. Newer machines are more energy-efficient, which can save money on utility bills. They can also handle larger loads, which means more customers can be served at once. This can lead to increased revenue and shorter wait times. Some laundromats are also adding amenities, such as Wi-Fi and cafes, to their facilities. This can make the laundry experience more enjoyable for customers and can also generate additional revenue. However, funding these investments can be a challenge. Loans can be expensive, and the payments can strain cash flow. Laundromats need to carefully consider their options when making these investments.

Potential equipment purchases could include:

- Replacement Commercial Washer/Dryers: $1,000 – $3,000

- POS Systems: $100 – $4,000 System for dropped off laundry services.

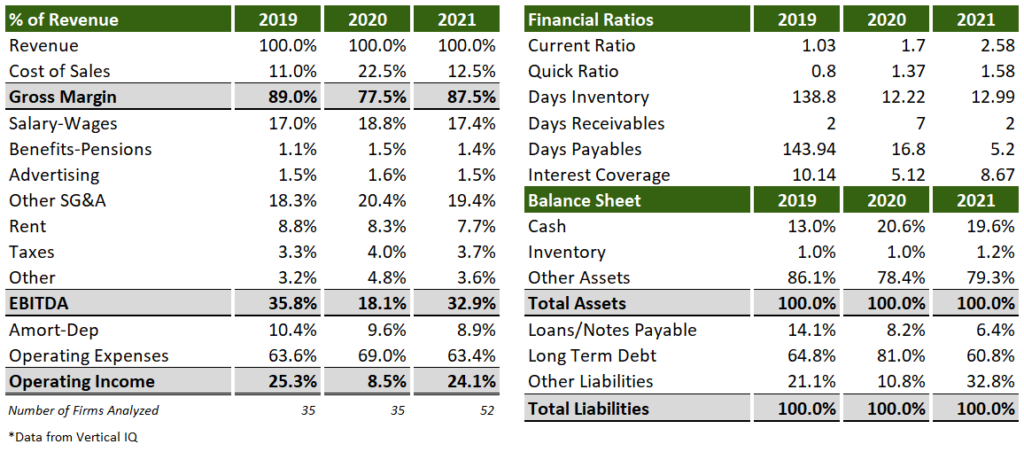

Recent Industry Metrics (Companies <$5M revenue)

Highlights from this vertical analysis and financial ratios:

- Days receivables is merely making the trip to the laundromat to collect every other day.

- Many of these businesses are financed through loans leading to highly leveraged businesses.

- Margins may have been compressed during COVID from lack of amenity options providing higher margins.

If you liked this, subscribe to my newsletter below!

For more information on building financial models see here.

Please contact me here if you found this useful or want more information.