What’s in this edition:

- News/Publications to follow

- Financial considerations for your self storage business plan

- Industry metrics for guidelines

Public Information to Follow

Financial Considerations for your Business Plan

Seasonal cash flow

Summer tends to be a popular month for self storage. That’s because most people move during this time, which leads to higher occupancy rates and increased revenue from sales of storage supplies and truck rentals. But self storage companies also need to make sure they have enough long-term tenants to avoid having low occupancy rates during the slower winter months. Typically, they aim for around 40-45% occupancy to break even.

Payment collections

Every month, self storage services have to handle a high number of rental payments that are usually small in amount. To encourage customers to pay on time, companies often use late payment fees and the possibility of taking away the contents of the storage unit. But there’s an easier way to handle payments! Setting up automatic payment through a credit card or electronic debit can reduce the chances of payment issues and save the companies time and money on administration.

Marketing strategies to grow sales

Self storage is a highly competitive industry. To keep up their occupancy rates and bring in new customers, companies focus on marketing in their local areas. But here’s the tricky part: it can be tough to fund marketing campaigns leading up to the busy summer season since cash flow is usually lower in the winter and spring months.

Profit drivers

- Maximizing Capacity – Maintaining high occupancy rates is crucial, and companies need long-term tenants to avoid occupancy falling below 40-45% in slower winter months. Effective local marketing is important to attract new tenants as most customers live within a three mile radius of a facility.

- Payment Collection – Setting up automatic payments with credit card or electronic debit can help reduce collection issues and administrative costs. Operators may sell the contents of a storage unit after a certain number of missed payments, but this seldom compensates for lost rent. Consistent early communication is essential in managing delinquent payments.

- Superior Customer Relationships – In over-saturated markets, self storage services compete on customer service, which requires professional management staff that can provide a clean and welcoming office environment, and show sensitivity to customers’ storage needs, which are often related to stressful situations.

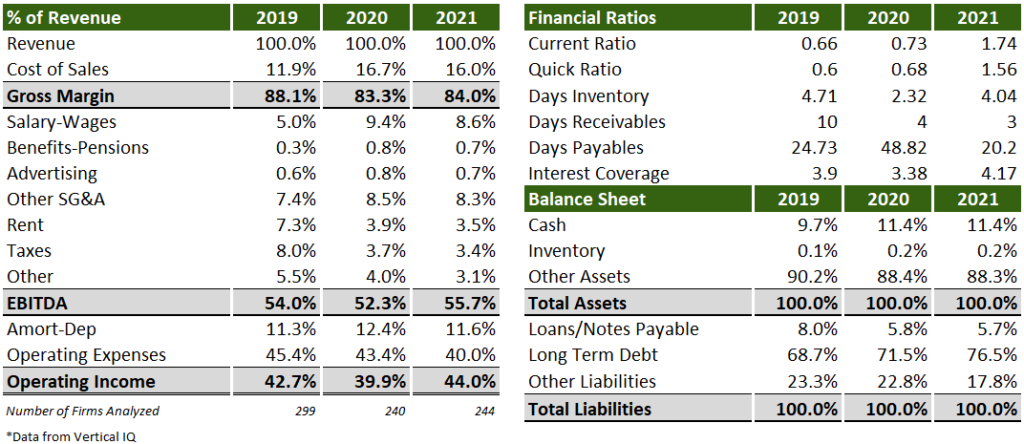

Recent Industry Metrics (Companies <$5M revenue)

Highlights from this vertical analysis and financial ratios:

- The increased cost of sales are primarily driven by increased payroll wages associated with sales of units.

- Days payables increased during the pandemic but dropped below pre-pandemic levels.

- As interest rates rise, valuations decline which will impact sales of self storage units and increase the need for efficient locations.

If you liked this, subscribe to my newsletter below!

For more information on building financial models see here.

Please contact me here if you found this useful or want more information.